Charge

Consumption tax is included in all prices below.

Charge of Orthodontics

| Consultation Fee | Free |

|---|---|

| Examination Fee | ¥33,000 |

| Diagnosis Fee | ¥33,000 |

| Child Orthodontics Fundamental Fee |

¥330,000 |

|---|

| Partial Orthodontics (Braces) |

Need to evaluated first (total ¥55,000~) |

|---|

| Adult Orthodontics (Braces) | Clear Plastic Braces with Metal Wires | ¥770,000 |

|---|---|---|

| Clear Ceramic Braces with White Wires | ¥880,000 | |

| Metal Braces with Metal Wires | ¥715,000 |

※ In most cases, all devices (except mini screws) fees are covered by fundamental fee. However, in few cases, it is necessary to use auxiliary devices with additional charge. We will explain to patients and ask for admission previously in these situations.

| Fundamental fee | Difficulty level 1 (Express; mild partial correction) | One jaw ¥170,000 |

|---|---|---|

| Both jaws ¥203,000 | ||

| Difficulty level 2 (Light; moderate partial correction; mild full jaw correction) | One jaw ¥253,000 | |

| Both jaws ¥341,000 | ||

| Difficulty level 3 (Moderate; moderate full-arch orthodontic treatment) | ¥616,000 | |

| Difficulty level 4 (Comprehensive; Extraction case; Severe full-arch orthodontic treatment) | ¥770,000 |

Before starting active treatment, you must first pay the production fee for the aligner (approximately half of the above fundamental fee). The aligner cannot be ordered until the production fee is fully paid.

| Mini Screw (if necessary) | Plus ¥16,500 per screw |

|---|

| Retainers | Plate Type | One jaw ¥22,000 |

|---|---|---|

| Fixed Type | One jaw ¥11,000 | |

| Clear Mouthpiece Type(Biostar®) | One jaw ¥5,500 | |

| Clear Mouthpiece Type ( Vivera® , genuine product of Invisalign®) | One jaw ¥11,800 | |

| Both jaws ¥15,100 | ||

| 3 sets one jaw ¥26,100 | ||

| 3 sets both jaws ¥37,100 |

| Adjustment Fee | ¥5,500 per appointment |

|---|

| Retention/Follow Up Fee | ¥3,300 per appointment |

|---|

Deduction for Medical Expenses

This is a system to have a deduction to deduct medical expenses from tax value of the year during the final income tax return, if the medical expenses are higher than a certain amount.

About Medical DeductionThe amount of medical deduction from taxation value can be calculated from a formula: “(amount of medical deduction) x (income tax rate)”. Amount of medical deduction is the value that can be taken off from the income. If whole income is over 200 million yen, amount of medical deduction can be calculated by another formula:。

(self medical expense + medical expense of all family of the year)- (amount of expenses covered by insurance) – ¥100,000

The income tax rate depends on the amount of income, please refer to following link.

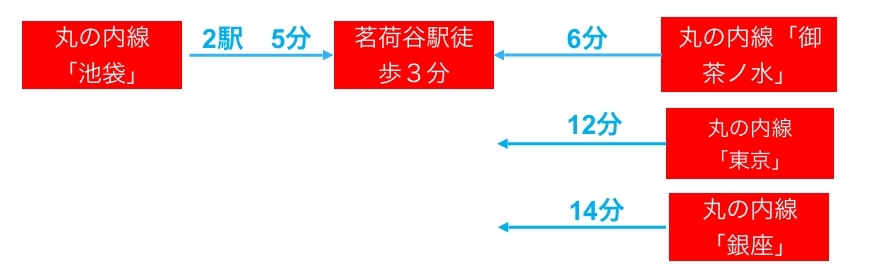

About Income Tax RateConveniently Located Near You – Just 3 Minutes on Foot from Myogadani Station

Only 5 minutes from Ikebukuro, 6 minutes from Ochanomizu, 12 minutes from Tokyo Station, and 14 minutes from Ginza via the Tokyo Metro Marunouchi Line.

We welcome many consultations and visits from nearby areas. Feel free to make a reservation.

Tooth Whitening

| Office Bleaching | ¥33,000 |

|---|---|

| Home bleaching | ¥27,500 |

| Additional Bleaching Gel | ¥5,500 |

※We have set menus of bleaching combined with PMTC.

to Tooth Whitening

Menu of Hygiene Maintenance

| Tooth Cleaning | PMTC + Fluoride Coating | ¥13,200 |

|---|---|---|

| Patient Having Orthodontic Treatment in Our Clinic | ¥5,500 |

| Under 6th Grade of Elementary School | PMTC + Fluoride Coating | ¥550 |

|---|

| Stain Remove | Air Flow Jet Polishing | ¥7,700 |

|---|---|---|

| Patient Having Orthodontic Treatment in Our Clinic | ¥5,500 |

Frequently Asked Questions

Q. What kind of pain is associated with orthodontic treatment?

A. In the case of wire braces, there is pain for about 2-3 days after each monthly adjustment, and for aligner braces, the pain occurs when switching trays. Since tooth movement itself is a type of inflammatory response, this pain is a sign that the teeth are starting to move. The feeling of tightness, teeth feeling loose, or discomfort when chewing can vary from person to person. However, everyone who starts treatment gets used to it over time, so don’t worry.

Q. How long does the treatment take?

A. It varies greatly depending on the complexity, but for adults, we usually say around 2 years. After that, the retention period, where a retainer is worn full-time, is about 6 months to 1 year. For children, more details can be found on our pediatric orthodontics page, but if we intervene at the optimal timing, treatment usually lasts around 2 years. We aim for a simple and efficient treatment plan for moving the teeth.

Q. I’m concerned about the cost and payment methods. What are the options?

A. Treatment costs are listed in the price table, so please check. As for payment methods, interest-free installment payments are available at our clinic. Please consult with us about the number of installments you’d prefer.

Q. Is it always necessary to extract teeth?

A. The decision on whether to extract teeth (usually premolars) is based on the proportion between the size of the teeth and the size of the dental arch (width and depth). Patients with small teeth and large dental arches don’t need extractions, but those with large teeth and small dental arches (crowded teeth) often require extractions. The prominence of the lips (profile) is also directly related to the depth of the dental arch, so if you have an overbite and want to improve the protrusion, extracting premolars is usually necessary. Conversely, if the lips are not protruding, extracting teeth could cause the front teeth to tilt inward and the lips to recede too much, so extraction isn’t recommended.

The tricky part is when the ratio is somewhere in between. Aesthetics, particularly regarding lip prominence, are subjective, and there’s no absolute standard. We sincerely listen to our patients’ preferences while providing our professional opinion, and we carefully assess whether extractions are necessary or if treatment is possible without extractions.

Q. Up to what age can orthodontic treatment be done?

A. As long as the periodontal ligament (the tissue around the tooth root) is intact, teeth can move at any age, so age is not a limiting factor. However, the bone around the teeth may become thinner or lower with age. Moving teeth in areas with less bone requires more care, applying gentler forces. This is one of our clinic’s strengths, so you can undergo treatment at any age. Many patients start treatment in their 40s to 70s, so feel free to consult with us regardless of your age.